…questions why price has fallen since Dangote refinery entered the cooking gas market

Oredola Adeola

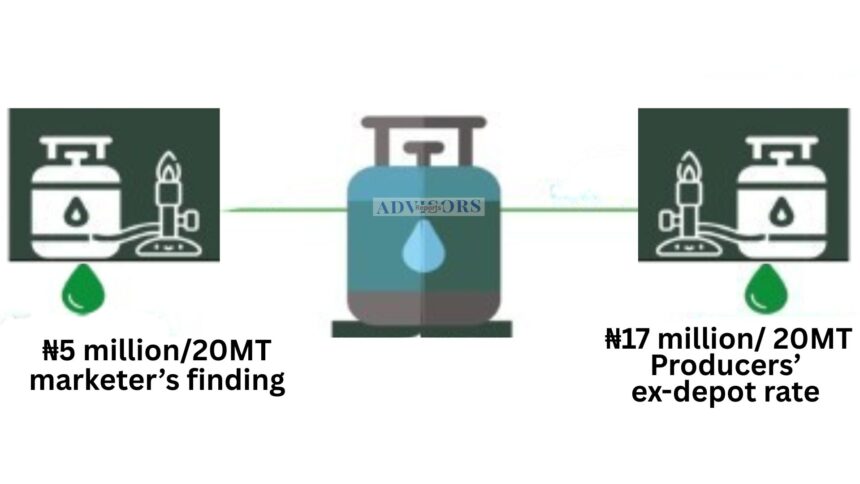

Engineer Anslem Olawoye, Managing Director of Foks JV Nigeria Ltd. revealed that 20 Metric Tonnes (MT) of Liquefied Petroleum Gas (cooking gas) should cost about ₦5 million- far below both the previous ₦24 million and the current ₦17 million per 20MT – regardless of the Naira’s devaluation, criticising Nigeria’s gas producers for what he described as an exploitative pricing framework in the market.

He therefore challenged gas producers to a transparent pricing review involving NALPGAM, the Minister of State Petroleum Resources (Gas), NMDPRA, and other key stakeholders.

Olawoye, made this revelation during a panel session on “Regulatory Framework for LPG, Challenges & Opportunities,” at the Nigerian Association of Liquefied Petroleum Gas Marketers (NALPGAM) 2025 National LPG Conference & Exhibition in Lagos.

The MD, Foks JV Nigeria Ltd. insisted, “In LPG costing, honestly, the price of LPG as of today, irrespective of the devaluation of the Naira, should not be more than ₦5 million per 20MT, even instead of ₦17 million per 20MT supposedly claimed.”

He also questioned why LPG prices, once pegged at ₦24 million per 20MT, have been on a downward trend since Dangote began injecting its LPG into the market.

Olawoye, who is also a member of the NALPGAM, further argued that NALPGAM has a clear line of sight on the actual pricing template, stressing that there are standard indices for determining production costs.

According to him, there are clear standard indices for determining LPG production and pricing, and anyone in doubt should subject the template to public scrutiny.

He warned that the sharp gap between the actual cost and exploitative pricing is driving up household cooking gas prices, crippling LPG marketers, and stifling the growth of the domestic gas market.

Olawoye warned that unless the LPG pricing framework is addressed, Nigeria will continue to face infrastructure deficits and declining investor confidence, as funding will not flow into the sector under the current regime.

He said, “There has never been a true pricing structure for LPG despite deregulation, and the NMDPRA is committed to reviewing the framework in line with the provisions of the Petroleum Industry Act.

“For instance, there is no reason why LPG producers in Nigeria benchmarking gas against international prices are.

“This is awkward and completely wrong. These gases are produced in Nigeria, extracted here and utilised here, so what is the justification for benchmarking it internationally?” he queried.

He described the practice as exploitative, noting that in many countries, consumers buy LPG in local currency.

Speaking further on affordability, Olawoye highlighted the huge infrastructure gaps in the LPG value chain, noting that many plant owners are unable to tackle the problem due to limited access to funding.

He stressed the need for collaboration to fully utilise available waivers on LPG facilities and drive investment.

Speaking on the opportunities, Engr. Olawoye pointed out that Nigeria’s growing population and its estimated 209.26 trillion cubic feet (TCF) of natural gas reserves present massive investment potential for the industry.

“If the gas is there, the investment potential is huge because the market is available,” he said.

Olawoye also underscored the need for a cost-effective, local solution to transport LPG across the country.

Citing crude oil pipelines as an example, he explained that their pressure capacity could equally support LPG transmission, and with interconnection provisions already in place for product exchange, such pipelines could be used to service northern Nigeria.