… APPO, Afrexim Bank technical inspection team validates Nigeria’s readiness to host AEB hqtrs

Oredola Adeola

President Bola Ahmed Tinubu has approved $100 million investment from four key agencies under the Ministry of Petroleum Resources, surpassing the minimum equity requirement of $83.33 million for class A shares in the Supranational Multilateral $5 Billion Africa Energy Bank.

This decision follows the completion of a technical inspection by the African Petroleum Producers Organization (APPO) and Afrexim Bank, on Friday, to validate Nigeria’s readiness to host the headquarters of the African Energy Bank, set to be established in July 2024.

Ambassador Nicholas Agbo Ella, Permanent Secretary, Ministry of Petroleum Resources made this known in a statement obtained by Advisors Reports on Friday.

According to him, following the first bidding round in early 2024, Nigeria, Ghana, Benin, and Algeria were pre-qualified to proceed to the final round of bidding.

He said, ” These countries will compete for the right to host the Supranational Multilateral $5 Billion Africa Energy Bank, which will finance Africa’s hydrocarbon deposits of oil, gas, and condensates and support energy transition and net zero 2060 commitments.

“In our preparation for the bid, the Ministry of Petroleum Resources sought and obtained expert opinions from the Federal Ministry of Justice and consultants in January 2024.

“They reviewed and approved the Bank’s proposed Charter, Establishment Agreement, “The Treaty,” and Headquarters Host Agreement.

“This approval provided the impetus to proceed, and the Federal Executive Council and National Assembly are currently finalizing the ratification process.

“This will ensure that the AEB receives the necessary privileges and immunities to operate in line with its global vision,” he said.

The Permanent Secretary also emphasised that the Nigerian Government has also identified a prestigious building in Abuja for the temporary headquarters and opened a secured data room for the technical team’s review.

He further said, “The application form for land for the permanent headquarters in the Central Business District of Abuja has been submitted for approval.

“This decision positions Nigeria favorably to win the bid, potentially reshaping the country’s oil and gas ecosystem.

Ambassador Ella therefore emphasised that the Ministry of Petroleum Resources also confirms that Nigeria is working with Nigerian National Petroleum Company Ltd. (NNPCL), and the Nigerian Content Development Monitoring Board (NCDMB), to meet all eligibility criteria.

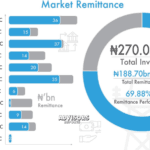

He said, “The $5 Billion Africa Energy Bank, when headquartered in Nigeria, shall be the largest single foreign direct investment inflow into Nigeria in over two decades with its benefits including:

“The Africa Energy Bank eco system shall rank as the third largest Bank in Africa and shall be the most prominent bank in Nigeria in terms of shareholders’ funds.

” It will significantly boost Nigeria’s Gross Domestic Product, Employment, Financial Architecture, and Inclusion, and propel our economic diversification while supporting foreign exchange management strategies.

“It will pivot the development exploration and investment initiatives by our Independent Petroleum Producers, Commercial service providers, Legal and local content drivers, and technology and skills development that will leverage the bank’s proximity to the market and scale up production and capacity.

” Our financial services industry and Capital markets will enjoy streamlined depths and flows for syndication, product development, and asset liquefaction, factoring all relevant services to hydrocarbon markets.

“This will position Nigeria as the main financial hub for oil and gas downstream, midstream, and upstream investment funding by mitigating the headwinds from climate change and energy transition optics with positive multipliers.

“The $5 Billion AEB is expected to grow its assets to over $120 Billion in 7 years, thus becoming a source of sustainable FDI for Nigeria that supports our vision 2030 ambitions, he stated.

The Permanent Secretary therefore noted that the African Energy Bank upon take-off is expected to attract an additional $2 Billion equity in classes B and C from African Sovereign wealth funds, National oil companies, and other Institutional investors whose investment objectives are aligned with the vision and mission of the bank.

According to him, the Afrexim-Bank board has committed to Invest $1.250 Billion, as a major investor in class A shares alongside the APPO members club.