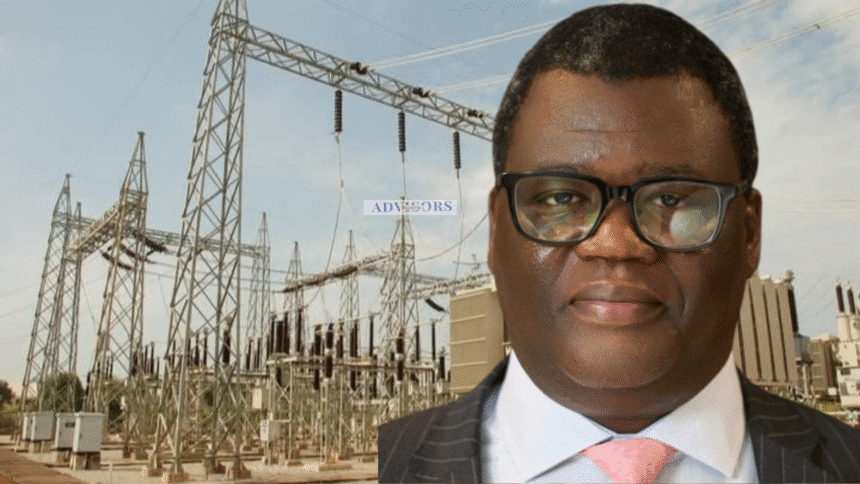

Mallam Ahmad Damcida, CEO/Managing Director of Energy Culture, during a Q&A session with Advisors Reports, evaluates the Federal Government’s current approach to financing the power sector, offers bold reforms for DisCos, and calls for accountability in the use of multilateral loans.

This is coming on the sidelines of over $6.45 billion that the President Bola Tinubu’s administration in 25 months has borrowed from the World Bank for various power sector initiatives, including a $750 million package specifically for recovery and another $750 million for renewable energy. Excerpts.

What is your overall assessment of the Federal Government’s approach to financing the power sector through international loans?

The truth is, borrowing isn’t inherently the problem. The real issue lies in how those funds are managed and implemented.. However, without transparent and independent audits, most of these funds are either mismanaged or misallocated.

Has almost $8billion of the loans released so far, translated into tangible outcomes in the power sector?

Unfortunately, not significantly. While there are frameworks like “Recovery, Reinforcement, and Repositioning,” the actual impact is minimal because of the structural and governance failures.

Recovery involves injecting liquidity, reinforcement aims to enhance technical capacity, and repositioning is about decentralizing the grid. But none of this works if there’s no clear audit trail or if loans are spent without accountability.

Could you elaborate on the government’s meter financing strategy for the sector in Nigeria?

The government has been offering concessionary loans to DisCos for prepaid meters, arguing that customers cannot afford them. But that’s misleading.

These prepaid meters are sold below cost due to flawed agreements signed during the privatization era.

DisCos say their hands are tied by those sale and purchase terms. Rather than funding these meters through loans, the solution is to make the DisCos financially viable and accountable through public ownership on the Nigerian Stock Exchange.

I want to advocate for the floating DisCos on the stock market. This is a simple initiative that will ensure transparency, corporate governance, and shared ownership.

The government currently holds 40% equity in DisCos via the BPE, while 60% is held by private investors. I propose to float a significant portion of these shares on the Nigerian Stock Exchange, with a cap that no single entity owns more than 5% of the floated 60%.

This would dilute monopolistic control, introduce investor discipline, and allow ordinary Nigerians, including pension funds and market women, to invest.

Public ownership of these assets can drive responsible consumption across Nigeria.

For instance, most people bypass meters in major cities across Nigeria, including Lagos, Port Harcourt, Abuja, and Kano, because they feel no sense of ownership.

If Nigerians own a stake in the power system, they will protect it. But right now, people build homes deliberately wired to bypass metering. This must stop.

What is your view about mini-grid funding from development partners like the World Bank?

The mini-grid space is one of the most abused. Grants and subsidies are being awarded without proper technical due diligence. Some projects receive $10 million but allocate over $1 million to consultancy, legal, technical, and environmental. Who audits these costs? Often, it’s not even an independent auditor. That’s unacceptable.

What is the structure which needs to be in place to curtail this abuse?

The Ministry of Finance should independently appoint auditors, not the Rural. Electrification Agency(REA) or any project beneficiary.

These auditors must be drawn from the Big Four accounting firms, including Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY) and KPMG, selected per project, not on retainer. That way, there’s a clear benchmark, actual fund utilization, and technical verification of outcomes.

Note also that many mini-grid projects in Nigeria are rushed, poorly designed, and do not meet performance standards, because of the uncoordinated funding and loan mechanism.

At Energy Culture, we built a solar-powered EV charging station that operates over 95% off-grid using 215 solar panels, no grants, no loans. Yet, I haven’t seen a mini-grid project in Nigeria that matches it. That shows what is possible with self-funding and technical integrity.

With the magnitude of funds committed into power sector infrastructure over the years, why is the power crisis appearing insurmountable?

The behavioural patterns of both consumers and operators are a big part of the problem. For instance, some government institutions owe DisCos massive debts.

Yet, DisCos can’t cut them off because their meters are inside military barracks or other protected premises.

Additionally, the public bypasses meters, while estate developers ignore utility planning norms.

Going forward, the DisCos should be part of building approvals, especially for electrical integration.

What other innovative approach can the Minister of Power, Chief Adebayo Adelabu deploy to salvage the present situation?

Chief Adelabu has taken commendable commercial steps since he came onboard, but he needs to go deeper. He should revisit the original Sale and Purchase Agreements signed during the power sector privatization to understand the contractual obligations and flaws. He should not just rely on NERC’s recent regulations. He need to address the root cause.

He should work with the Ministry of Finance to enforce accountability in the entire value chain. Structure must also be put in place to ensure that whosoever approved loans for non-performing projects should be called to explain, even post-tenure.

What role can the National Assembly play to provide legislative oversight on these loans?

The National Assembly should mandate that every project tied to public borrowing must have traceable implementation outcomes. Ministers and officials involved in those approvals must remain accountable even after leaving office. We cannot keep piling on debt without results. Infact, the law must be firm in ensuring that project must have already commenced before they can access loans

The Federal Government must learn to balance foreign loans with domestic capital formation. Floating DisCos’ shares is one such strategy. We must also reform our regulatory frameworks, upgrade outdated infrastructure, and create a reliable, market-driven electricity system. That’s how to ensure good governance and ultimately, energy security.